PadSplit

Social Impact

Report

The housing crisis has reached an all-time high: Housing is unaffordable for half of all renters.

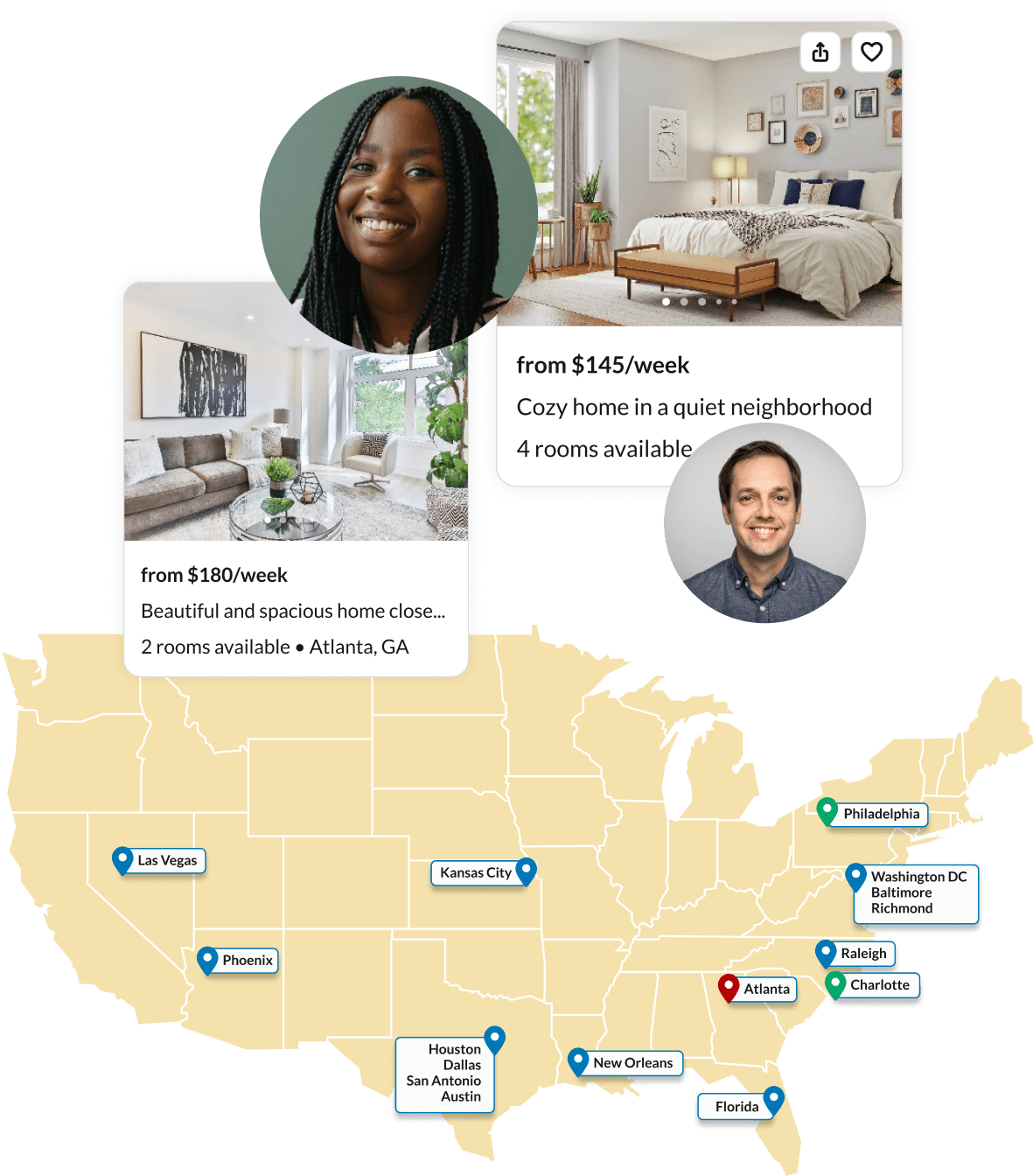

At PadSplit, our mission is to help solve the affordable housing crisis while leveraging housing as a vehicle for financial empowerment. We do this through our tech-enabled marketplace that connects the low-income workforce with affordable housing options.

We fundamentally believe that the people who serve our communities also deserve an opportunity to live in them, and unlike other co-living companies, PadSplit is designed specifically for the workforce.

Top three reasons our members choose PadSplit:

- Ability to move-in and out fast (usually within 48 hours)

- Affordability (40-50% cheaper than traditional apartments)

- Flexible lease terms (long-term commitments are not required)

The PadSplit Model

PadSplit is a public benefit corporation, which means we have a fiduciary obligation not just to our shareholders, but also to provide affordable housing for low-income earners (below 80% AMI). We achieve these objectives by aligning incentives between cities that desperately require affordable housing, property owners who seek returns on investment, and individuals who need quality housing close to their jobs.

PadSplit aligns incentives to create housing supply and access.

Renters need more affordable housing options with fewer barriers to access.

Housing providers are incentivized by higher returns on investment and decreased risk.

Cities need to house workers, but often endure barriers to developing affordable housing quickly and cost-effectively.

Millions of Americans working as teachers, firefighters or factory workers simply can’t afford to rent apartments, or credit problems mean they can’t get approved to rent. PadSplit takes people with eviction histories or weak credit but still makes it work with modern real estate management practices: It claims a 97.5 percent collection rate.

Nicholas Kristof

2x Pulitzer winning journalist,The New York Times

All-inclusive co-living designed for workers

| Other Housing Options | PadSplit Member | |

|---|---|---|

| Easily transfer across any of PadSplit's 11,000+ units | ||

| Private, lockable bedroom | ||

| Access to a washer and dryer | ||

| Furnishings | ||

| All utilities and Wi-Fi | ||

| Access to telemedicine | ||

| Positive rent payment reporting | ||

| Weekly, customizable payments, timed to your pay periods |

Why is PadSplit needed?

Affordability

The national "housing wage", the hourly wage full-time workers must earn to afford rent without spending more than 30% of their income, is $23.67. This means fair market rent for a 1-BR apartment, with utilities, is $1,180 per month. The average PadSplit room costs $729 per month and includes utilities.

Accessibility

Credit scores and eviction histories exclude many from the housing market. We aim to be an accessible option, and therefore, PadSplit does not require a minimum credit score or clean eviction history to qualify for membership.

Efficiency

PadSplit uses existing housing stock to bring on supply quickly. This means more people can be housed, more quickly.

Median rent costs have rapidly outpaced income growth. By 2022, half of all U.S. renters were cost burdened: meaning they spent more than 30% of their income on rent and utilities.

Source: 2023 NLIHC Out of Reach Report, 2023

“I love that I found PadSplit; it literally saved my life. I was coming out of a bad relationship, and I ended up sleeping in my car. After trying to get an apartment and getting rejected a few times I decided to give it a try. PadSplit gave me a second chance.”

Joe Floyd - PadSplit member

PadSplit vs. Traditional Rentals

| Atlanta 1-Bedroom Apartment |  | ||

|---|---|---|---|

| One-Time Move-In Costs | Average Deposit | $1,880 | $0 |

| Average Application Fee | $75 | $19 | |

| Average Admin Fee | $150 | $100 | |

| Average Furniture Cost | $1,500 | Included | |

| Total One-Time Move-In Costs | $3,605 | $119 | |

| Atlanta |  | ||

|---|---|---|---|

| Monthly Costs | Average Monthly Rent | $1,880 | $729 |

| Average Monthly Utilities | $200 | Included | |

| Average Monthly Internet | $75 | Included | |

| Total Monthly Housing Costs | $2,155 | $729 | |

About

PadSplit’s

members

90%

would recommend PadSplit to a friend.

$27,000

Median annual income for residents.

54%

report improved job stability.

80%

are employed. Of those who are, 77% commute to their jobs.

50%

pay off debt.

$366

Average money saved each month.

75%

of members are persons of color.

9.3 months

Average length of stay.

36

Median age of residents.

“Without PadSplit, I would be homeless until senior housing called me. Who can be homeless for two years waiting? What are we supposed to do in the meantime? PadSplit has given me a safe place to live.”

Terry - PadSplit member

“PadSplit has helped me in numerous ways. I was homeless, living out of my car for about six to seven weeks, and was lost. [I] came across PadSplit and was skeptical at first, but … I realized how beneficial it is for me. It helps create financial sustainability.”

Juan - PadSplit member, Atlanta, GA

How we’re making a difference

$5.49M saved per month across active members

$20.8+ million historical savings

58,500 members housed

$6+ billion saved in taxpayer dollars

$0 in taxpayer dollars

Economic impact

24,000

We’ve created more than 24,000 units for our residents.

X

$250,000

$250K is the average cost for government subsidized affordable housing in the U.S.

=

$6+ billion

With 24,000 rooms created, PadSplit has saved taxpayers more than $6+ billion.

Doing well and

doing good.

PadSplit is possible because it’s profitable for real estate property owners and hosts. PadSplits typically increase yield by more than 2X for property owners, spurring them to create more cost-effective housing supply. Nearly half of the property owners who become repeat PadSplit hosts list more rooms within a year.

2x

Increased NOI by more than

2x for owners

97.4%

collections rate

“We converted three of our Airbnbs to the PadSplit model when travel stopped during the pandemic. For us, it was an easy and natural shift, and we don't plan to convert them back. The flexibility has been key for our family with three kids under the age of five. The PadSplit team truly cares about members and hosts, and it’s nice to be a part of shaping a company that is doing good work.”

Brittany - PadSplit host