The Atlanta metropolitan area is facing a housing crisis. There’s not enough affordable housing for our low-income residents. At PadSplit, we’re committed to solving this issue, one room at a time.

Before we dive in, let’s take a closer look at the following: housing continuum and affordable housing. These elements play a crucial role in breaking the cycle of poverty facing Atlanta’s residents.

What is a Housing Continuum?

Housing continuum is a term used to describe the progression of individuals along a housing-focused continuum. Homelessness is at one end and homeownership is at the other. Along the continuum is the range of types of housing available to individuals in a community. This range includes shelters, transitional housing, cooperative housing, rental properties, private property, and everything in between.

If a community has a healthy housing continuum, it’s easy for people to progress along it. If a community’s housing continuum has gaps, it’s harder for people to progress from homelessness up to homeownership.

What is Affordable Housing?

The federal Department of Housing and Urban Development (HUD) defines affordable housing as a dwelling that a household can obtain for 30-percent or less of its income.

For example, let’s say an individual makes $30,000 per year. Thirty percent of $30,000 is $9,000. Divide $9,000 by twelve and you get $750. This means an individual making $30,000 per year would need to live in a dwelling that cost $750 or less per month for it to be considered affordable for them.

However, this simple formula doesn’t consider the cost of living in each area. An individual making $30,000 in a major urban area will struggle to find a place to live for $750 or less per month.

The State of Housing in Atlanta

The Atlanta metropolitan area is facing an affordability crisis that the housing continuum cannot fully solve because:

- There’s limited subsidized housing.

- Apartments are too few and unaffordable.

- Barriers to enter the housing market.

Let’s take a closer look at each of these reasons.

Atlanta’s Lack of Subsidized Housing

Nearly half (40%) of Atlanta’s 486,000 residents earn less than $35,000 per year and are housing cost-burdened. They struggle to make ends meet and find affordable housing.

The Atlanta Housing Authority has 16,979 Section 8 vouchers available. That’s only enough to serve roughly 10% of the city’s low-income residents.

At PadSplit, we estimate that Atlanta’s low-income resident population will grow to 400,000 by 2040 based on growth projections. This will only add to an already overburdened system.

Lack of Affordable Housing in Atlanta

PadSplit recently surveyed every apartment in the City of Atlanta listed for $1,000 or less per month. The results were surprising. We only found 260 units available for residents earning less than $35,000 per year with no housing subsidy.

But those 260 units are still out of reach.

The average price of these units was $866 per month. In order to afford that rent, a resident should earn at least $34,640 per year. Forty percent of Atlanta residents earn less than that.

Even if they could afford $866 per month, the additional barriers to entry keep these scarcely available units out of reach.

Barriers to Enter the Housing Market

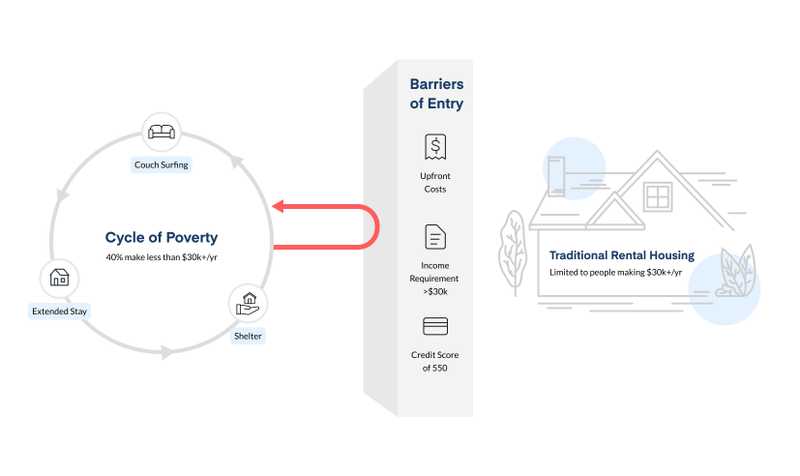

There are three primary barriers that prevent people from entering the housing market. They are income, upfront capital, and credit requirements. Let’s look closer.

1. Minimum Income Requirements

Most housing options have a minimum income requirement. Simply put, it means an individual or household must prove they earn at least a certain amount in order to live in the unit. The 260 units we found had income requirements. They were at least $30,136 per year or 2.9 times the monthly rent.

2. Upfront Capital Requirements

Most housing options require an initial investment from a tenant before they move in. This investment includes an application fee, deposit, administration fee, and furniture costs. Below is the average move-in cost we calculated based on the 260 units we found:

- $57 application fee

- $567 average deposit

- $142 average administrative fee

- $500 average furniture cost

- Total upfront capital required: $1,266

This doesn’t include the first month’s rent. When added to the upfront capital requirement, Atlanta’s low-income residents would need savings of over $2,100 to move into one of these 260 units.

Fifty-eight percent of Americans has less than $1,000 in their savings account. Atlanta residents making less than $35,000 per year have a median average savings of $0.

3. Credit Score Requirements

One-third of American households have FICO credit scores below 550 or no credit files at all. The average credit score requirement for the 260 units we surveyed was 550 or higher.

The end result for the 107,958 low-income Atlantans without a housing subsidy? They’re stuck in a cycle of poverty that’s hard to break.

Breaking the Cycle of Poverty

At PadSplit, we’re committed to breaking the cycle of poverty in Atlanta. That’s why we offer an affordable housing solution that fills our city’s housing continuum gap. PadSplit is a membership program. For a low, fixed weekly payment, you get a private, furnished room, utilities, internet access, and laundry facilities. The rooms are hosted by property owners or managers who are also Members. PadSplit facilitates the relationships between everyone and manages all the paperwork like payment processing and background screenings where available. We don’t require upfront capital or a minimum credit score to move in. In fact, the average score of PadSplit Members when entering is 469. Once you’re a Member, we’ll work with you to help build your credit history and improve your score. You only pay a refundable application fee for a background screening (where applicable). If your membership application isn’t approved, the fee will be refunded.

Ready to make the move? PadSplit has homes all over Atlanta, offering plenty of choices when it comes to different neighborhoods. Most of our homes are near bus lines, if not major transportation hubs, which means you don’t have to worry about the traffic. Apply today.